Bitcoin was trading just shy of $90,000 Monday night after breaching $80,000 just a day earlier.

The flagship cryptocurrency was last higher by 12% at $89,100, according to Coin Metrics. Earlier Monday, it rose as high as $89,623.00. Its price is expected by many investors to continue making fresh records on its way up to $100,000 later this year.

“Bitcoin is now in price discovery mode after breaking through all-time highs early last Wednesday morning when it was officially declared that Trump won the election,” said Mike Colonnese, an analyst at H.C. Wainwright. “Strong positive sentiment is likely to persist through the balance of 2024 and [we] see bitcoin prices potentially reaching the six-figure mark by the end of this year.”

Crypto investors have been cheering President-elect Donald Trump’s promises to make the regulatory environment more supportive and even friendly toward crypto businesses, which have long struggled with a lack of clarity of the rules of the road.

While bitcoin has long been deemed a safe asset in Washington – that is, not subject to securities laws – the long tail of cryptocurrencies and crypto-related startups have been operating in a risky grey area.

“That’s just shifted 180 degrees,” Matt Hougan, chief investment officer of Bitwise Asset Management, told CNBC. “We’re now in a positive regulatory environment, we now have tailwinds from that, and that comes in the case of a market that was already in a bull market … that’s going to push us higher.”

was trading higher by 5.8% Monday evening. Payments token XRP rose nearly 4% and the token linked to decentralized finance project Polygon gained more than 4%. Dogecoin

has been one of the biggest winners – likely due to its connection with Elon Musk, who helped get Trump elected. It’s up 38%.

In the stock market,Coinbase and others

gained about 3% and 5%, respectively, in extended trading. In the regular session on Monday, Coinbase surged 19% to trade above $300 for the first time since 2021. It’s now about 6% from its high from that year.

Traders and analysts agree this rally is just only beginning.

“It does seem like there’s an air gap between the previous [bitcoin] all-time highs around $72,000 and $100,000,” Hougan said. “It’s hard exactly to see what would force sellers to come into this market and halt the momentum before we get to that level. Of course, there are no guarantees. You could see pullbacks, but we’re in a new crypto market cycle. … I do think that we are right to be bullish and the bias is still on the upside.”

Bitcoin (BTC) trades around $82,000 on Monday, having reached a new all-time high (ATH) of $82,471 earlier in the day and extending last week’s 17% rally. Optimism in crypto markets is widespread after the victory of crypto-friendly candidate Donald Trump in the US presidential election. While the long-term outlook for BTC and other altcoins looks positive, chances of a short-term correction are also increasing following seven consecutive daily sessions of gains.

The rally was further boosted by over $1.6 billion in US spot Bitcoin Exchange Traded Funds (ETFs) inflows and a Federal Reserve interest rate cut. Moreover, historically, data suggest the continuation of the ongoing rally as Bitcoin has traditionally delivered strong returns in November. From a technical point of view, while the weekly chart suggests a continued bullish rally, the daily chart points to a short-term pullback.

Bitcoin surges following Trump’s victory, Fed rate cut

Bitcoin surged almost 17% last week, hitting a new high of $81,500 on Sunday. The rally was largely fueled by Donald Trump’s decisive victory in the US presidential election. His pro-Bitcoin stance and proposed policies, such as eliminating taxes on Bitcoin transactions and creating a strategic reserve, have sparked bullish sentiment in the crypto community.

Additionally, on Thursday, the Fed reduced interest rates by 25 basis points (bps), further fueling the ongoing rally in Bitcoin and the broader crypto market. Historically, cryptocurrencies have responded positively to low interest-rate environments, as lower borrowing costs boost investors’ purchasing power, encouraging them to invest in risky assets like Bitcoin rather than keeping funds in banks for higher returns.

Bitcoin has the highest average monthly returns in November

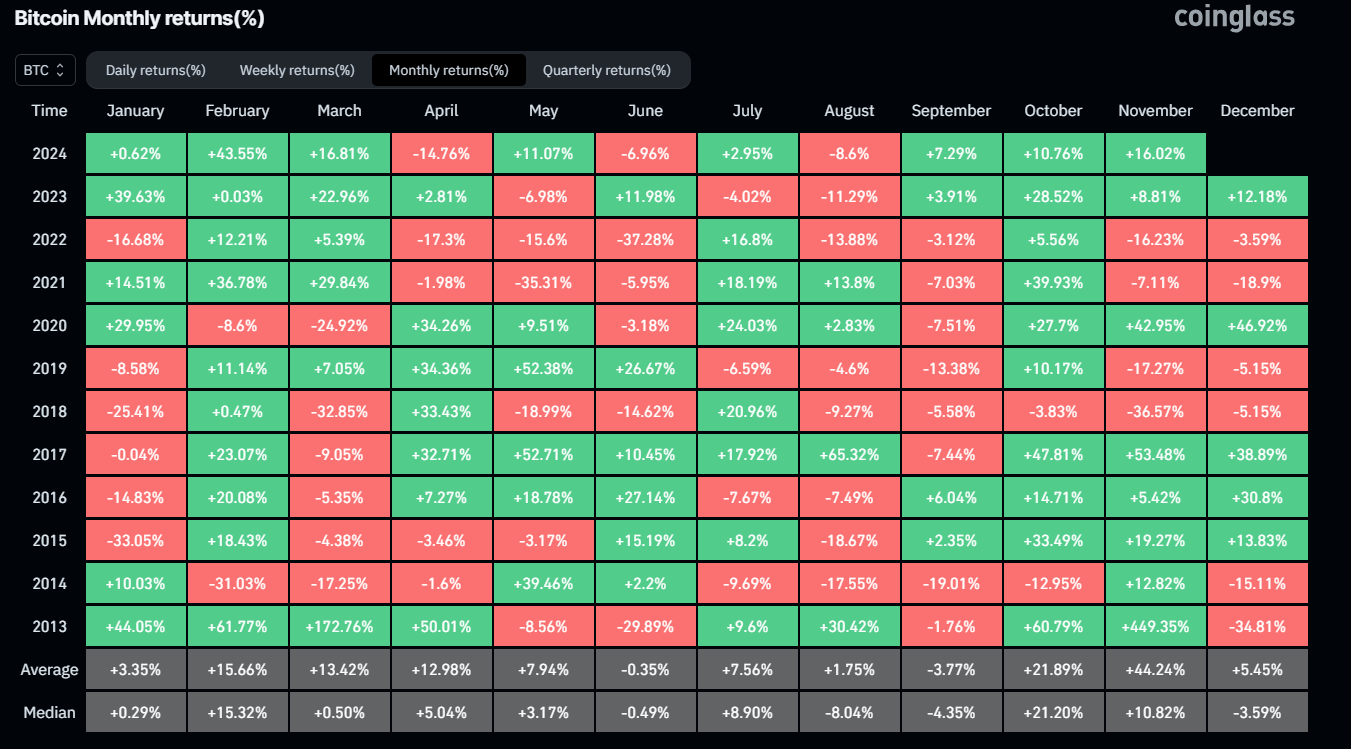

Coinglass’s Historical Bitcoin Monthly Return (%) data shows how

Bitcoin has performed in different monthly percentages. As shown in the

graph below, Bitcoin

generally yielded positive returns for traders in November, with an

average of 44.24%, by far the highest monthly average out of all 12

months. Read More

0 Comments